300 – 4,600 Points | Applicable to all Municipalities

A municipality’s decision to subscribe to clean Community Distributed Generation (CDG), and/or host or own clean distributed energy resources, like solar, hydro, wind, or battery energy storage, highlights its role as a leader in addressing climate change and protecting the environment.

Municipalities can receive points in the CEC program by subscribing municipal accounts to clean CDG (e.g., community solar), and/or hosting or installing clean distributed energy resources on municipal property.

As the CEC program strives to guide municipalities towards decarbonization and recognize their efforts, municipalities can gain additional points as they complete new actions over time. Municipalities can choose to complete any or all of the actions below.

CDG Subscription

300 points

Municipalities may subscribe to one or more clean CDG projects to receive utility bill discounts, saving money for the municipality. In addition, by municipalities entering into agreements to purchase energy as an “anchor” off taker, they may make it easier to develop CDG projects that benefit residents as well. This action encourages municipalities to serve as that anchor to enable more New Yorkers to benefit from CDG. Date of completion is when the CDG project began generating electricity.

Submission requirements:

Submit a bill from the utility or CDG host demonstrating an active municipal subscription to a CDG project.

Submit a completed Renewable Energy Certification Form (accessed in the Renewable Energy toolkit at www.nyserda.ny.gov/cec) showing the municipal electric load that is subscribed to CDG, including signing the certification that the applying municipality has NOT already received points for municipal CDG subscriptions through the Clean Energy Upgrades action in a previous round of the Clean Energy Communities program.

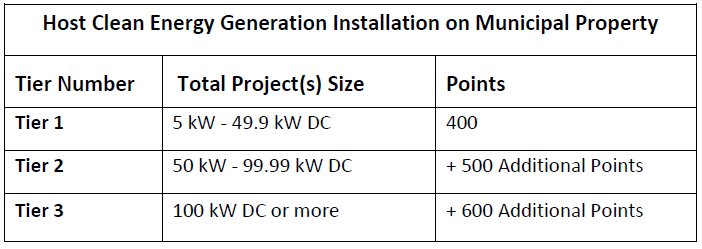

Host Clean Energy Generation Installation on Municipal Property

400-1,500 points

Finding suitable sites is one of the main barriers to siting solar, wind, or hydro. By allowing third-party owners to install clean energy installations on municipal rooftops, parking lots, landfills, or other sites, municipalities can address one of the key barriers to the clean energy transition. Municipalities can then take advantage of the installations through Power Purchase Agreements and/or CDG subscriptions. In addition, this action allows municipalities to host clean CDG projects, which provide utility bill discounts to local residents including low-income households. Eligible technologies for this action include solar, wind and hydro. The tiers and associated points for this action are cumulative and based on tier level accomplishment and must be submitted consecutively based on tier level of achievement. This action is not applicable to installations that the municipality owns (see Clean Energy Generation Installation Owned by Municipality to earn credit for municipality-owned installations). Date of completion is when the clean energy installation(s) started producing electricity. Municipalities that host a clean energy installation that started producing electricity on or after January 26, 2021 will be eligible for this action.

Different generation amounts will net municipalities greater clean energy benefits and greater points in the program.

Submission requirements for any of the above:

Submit a completed Renewable Energy Certification Form (accessed in the Renewable Energy toolkit at www.nyserda.ny.gov/cec) showing the location of the installation(s), the total size, and that the site(s) is currently producing electricity.

Submit a copy of the hosting agreement or a screenshot of an incentive approval in the NY-SUN Program.

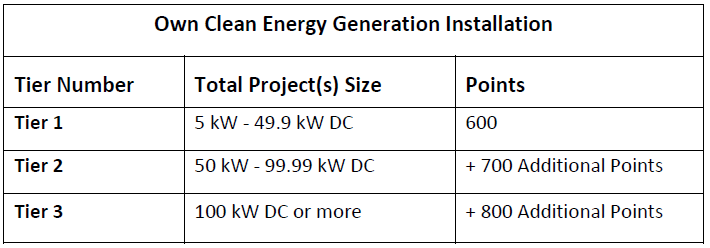

Clean Energy Generation Installation Owned by Municipality

600-2,100 points

With the recent passage of the Inflation Reduction Act, municipalities are now eligible for “Elective Pay,” which allows them to receive tax credits even though municipalities don’t pay federal income taxes, a positive change from prior tax rules. By owning a clean energy installation, municipalities may now receive all the financial benefits from the installation and can help more of the financial benefits stay local. The tiers and associated points for this action are cumulative and based on tier level accomplishment and must be submitted consecutively based on tier level of achievement. Date of completion is when the clean energy installation(s) started producing electricity. Municipalities that own a clean energy installation that started producing electricity on or after January 26, 2021 will be eligible for this action.

Submission requirements for any of the above:

Submit a completed Renewable Energy Certification Form (accessed in the Renewable Energy toolkit at www.nyserda.ny.gov/cec) showing the location of the installation(s), municipal ownership of installations, the total size corresponding to the requested points in the table above, and that the installation is currently producing electricity.

Submit the application number or a screenshot of an incentive approval in the NY-SUN Program. Or, if the project did not go through the NY-SUN Program, please submit an explanation on municipal letterhead for not applying to NY-SUN along with paid invoice and photographs of the completed project.

100% Renewable Electricity

700 points

A local government’s decision to purchase renewable energy for its electricity needs highlights its role as a leader in addressing climate change and protecting the environment.

Submission requirements:

Submit a completed 100% Renewable Electricity Certification Form (accessed in the 100% Renewable Electricity toolkit at www.nyserda.ny.gov/cec) or comparable information. Requested information includes the average annual load of all municipal electricity accounts and the percentage of the load that will be matched with New York renewable energy certificates (RECs) that are retired in a New York State Generation Attribute Tracking System (NYGATS). RECs generated by state-owned resources including New York Power Authority-owned facilities do not qualify. RECs must be produced in the same calendar year as the electricity consumption. To earn credit for this action, the electricity consumption must occur in 2021 and later.

Date of completion for this action is defined as the date after January 26, 2021 when the renewable energy is delivered.